Daycare Tax Deductions: Save Big with IRS-Approved Benefits

By A Mystery Man Writer

Last updated 16 Jun 2024

Discover essential daycare tax deductions for your daycare business, from travel expenses to childcare supplies. Get IRS-approved tips to maximize savings.

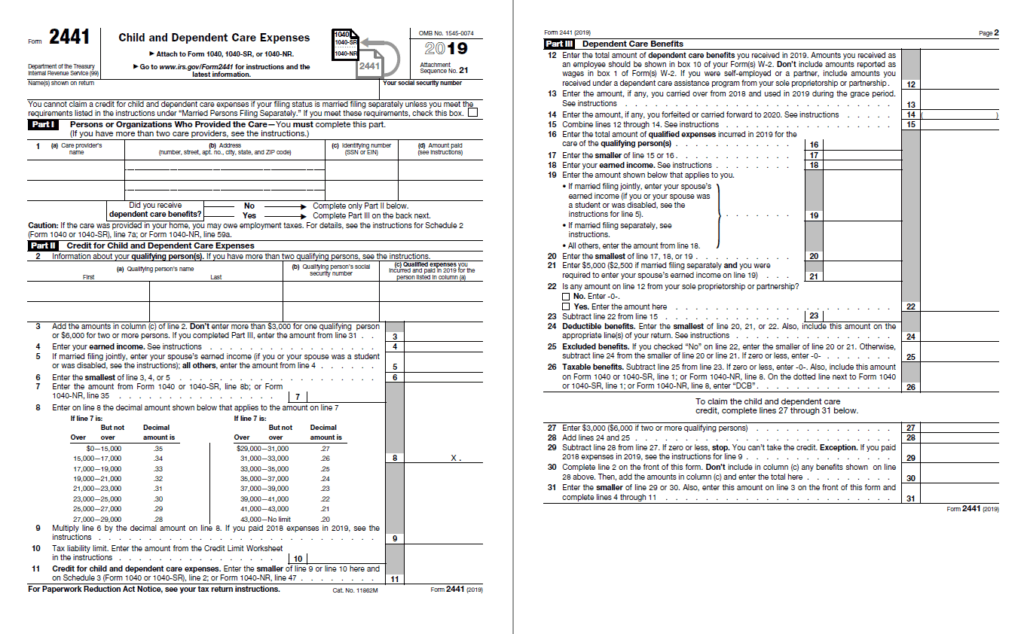

Child and Dependent Care Credit: Definition, How to Claim - NerdWallet

Dependent Care Benefits - Overview, Meaning, Finance

The Ins and Outs of the Child and Dependent Care Credit - TurboTax Tax Tips & Videos

Resource Hub

1040 (2023) Internal Revenue Service

Save Money with a Flexible Spending Account, Montgomery County Public Schools

Child Care Tax Receipt and Statements Guide & Templates

16 ways business owners can save on taxes - Clover Blog

IRS clarifies payment plans for expanded child tax credit, unemployment deductions as part of stimulus - That's Rich!

Recommended for you

-

Leinuosen 6 Pcs Stackable Sleeping Daycare Cots for16 Jun 2024

Leinuosen 6 Pcs Stackable Sleeping Daycare Cots for16 Jun 2024 -

Waterproof Baby Bottle Labels for Daycare Supplies, 7216 Jun 2024

Waterproof Baby Bottle Labels for Daycare Supplies, 7216 Jun 2024 -

Home Page - Childcare Supply Company16 Jun 2024

Home Page - Childcare Supply Company16 Jun 2024 -

Daycare Supplies & Preschool Furniture Supplies16 Jun 2024

Daycare Supplies & Preschool Furniture Supplies16 Jun 2024 -

Modern Daycare Furniture Montessori Preschool Furniture Early16 Jun 2024

Modern Daycare Furniture Montessori Preschool Furniture Early16 Jun 2024 -

Furniture Daycare China Trade,Buy China Direct From Furniture16 Jun 2024

Furniture Daycare China Trade,Buy China Direct From Furniture16 Jun 2024 -

Leinuosen 6 Pcs Stackable Sleeping Daycare Cots for Kids 52 L x 23 W Daycare Toddler Nap Cots Preschool Classroom Daycare Beds Daycare Furniture, Ready to Assemble for Kids Sleeping Resting16 Jun 2024

Leinuosen 6 Pcs Stackable Sleeping Daycare Cots for Kids 52 L x 23 W Daycare Toddler Nap Cots Preschool Classroom Daycare Beds Daycare Furniture, Ready to Assemble for Kids Sleeping Resting16 Jun 2024 -

Waterproof Baby Bottle Labels for Daycare Supplies, 72 PCS Personalized Name Labels for Kids School Supplies, Self Laminating, Dishwasher Safe, Removable Preschool Toddler Name Stickers Name Tags : Baby16 Jun 2024

Waterproof Baby Bottle Labels for Daycare Supplies, 72 PCS Personalized Name Labels for Kids School Supplies, Self Laminating, Dishwasher Safe, Removable Preschool Toddler Name Stickers Name Tags : Baby16 Jun 2024 -

Baby Bottle Labels for Daycare Supplies, 128PCS Waterproof Daycare Labels Self Laminating, Dishwasher Safe, School Name Labels Stickers for Kids Stuff, Toddler Name Tags for Plastic Water Bottle : Office16 Jun 2024

Baby Bottle Labels for Daycare Supplies, 128PCS Waterproof Daycare Labels Self Laminating, Dishwasher Safe, School Name Labels Stickers for Kids Stuff, Toddler Name Tags for Plastic Water Bottle : Office16 Jun 2024 -

IN HOME DAYCARE SUPPLY AREA16 Jun 2024

IN HOME DAYCARE SUPPLY AREA16 Jun 2024

You may also like

-

Golden Sonic Rings Sticker for Sale by greenviking199416 Jun 2024

Golden Sonic Rings Sticker for Sale by greenviking199416 Jun 2024 -

Disney Collectable Gifts - Disney - Gifts By Theme16 Jun 2024

-

Artists Sketch Board with Double Clips for Art Classroom, Studio16 Jun 2024

Artists Sketch Board with Double Clips for Art Classroom, Studio16 Jun 2024 -

99,8% Pure Potassium Cyanide For Sale In Different Forms, Potassium Cyanide, Research Chemicals - Buy United States Wholesale 99 $10016 Jun 2024

99,8% Pure Potassium Cyanide For Sale In Different Forms, Potassium Cyanide, Research Chemicals - Buy United States Wholesale 99 $10016 Jun 2024 -

What Causes English Ivy Leaves to Dry Up?16 Jun 2024

What Causes English Ivy Leaves to Dry Up?16 Jun 2024 -

Etimo Rose Crochet Hook Set16 Jun 2024

Etimo Rose Crochet Hook Set16 Jun 2024 -

Fast Way To Shorten A Necklace For an Event16 Jun 2024

Fast Way To Shorten A Necklace For an Event16 Jun 2024 -

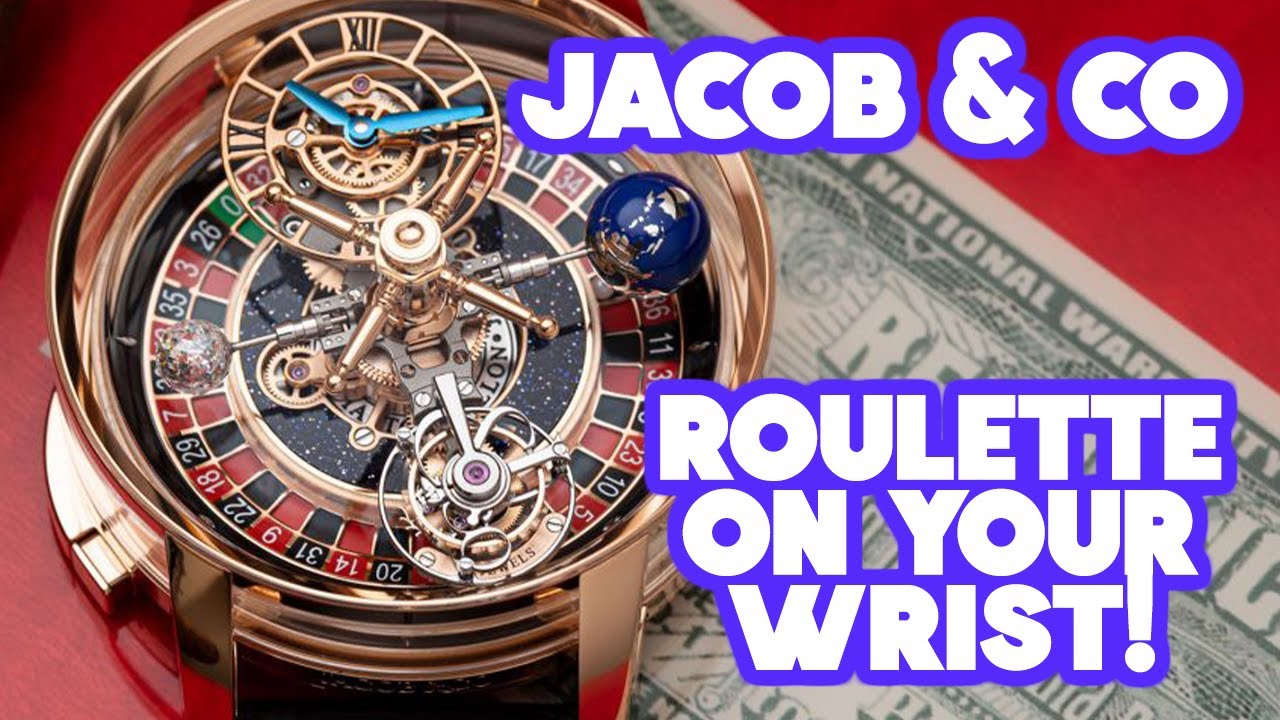

JACOB & CO ASTRONOMIA CASINO WATCH - Roulette Wheel On Your Wrist16 Jun 2024

JACOB & CO ASTRONOMIA CASINO WATCH - Roulette Wheel On Your Wrist16 Jun 2024 -

Rock Tumbler Refill Grit Kit with Pellets, FREE SHIPPING! – MJR TUMBLERS16 Jun 2024

Rock Tumbler Refill Grit Kit with Pellets, FREE SHIPPING! – MJR TUMBLERS16 Jun 2024 -

Wireless Engraving Pen Cordless Drill LED 5 Speed Rotary USB Dremel Grinding Kit16 Jun 2024

Wireless Engraving Pen Cordless Drill LED 5 Speed Rotary USB Dremel Grinding Kit16 Jun 2024