Step-By-Step: How To Claim Motor Vehicle Expenses From The CRA

By A Mystery Man Writer

Last updated 17 May 2024

See the methods and a step-by-step explanation of the five steps to claiming motor vehicle expenses from the CRA as a self-employed individual or an employee.

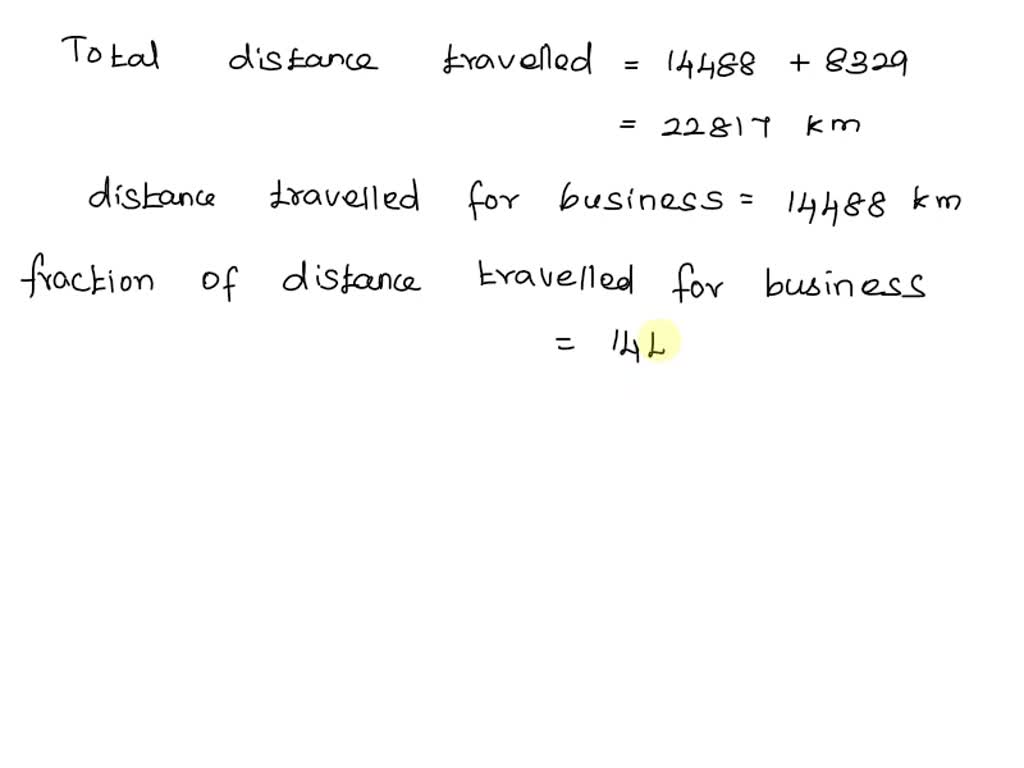

SOLVED: If you use your car for both business and pleasure, the Canada Revenue Agency will usually allow you to report a portion of the costs of operating the vehicle as a

Tax season 2015: 10 ways to attract a CRA auditor's attention

:max_bytes(150000):strip_icc()/businessmanreceiptsgetty-57a624813df78cf45908cf6b.jpg)

CRA Business Expenses (Canada)

Motor Vehicle expenses not showing any deductions in tax summary report

Canadian tax deductions for truck drivers list

How to Write-Off Vehicle Expenses in Canada

How to make the most of work-vehicle expenses on your tax return

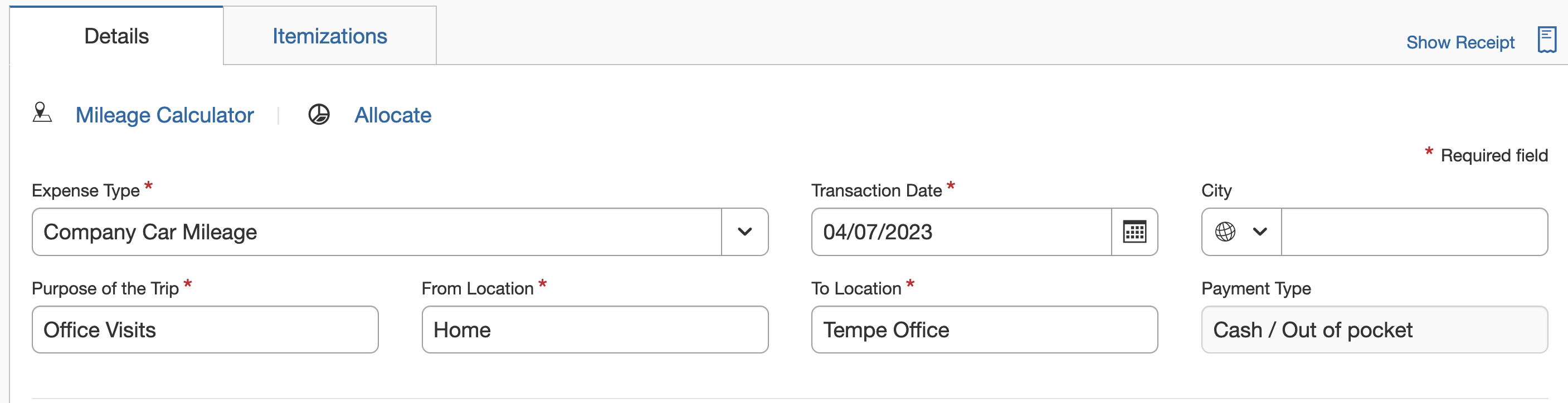

How Do I Submit or Claim Mileage in Concur Expense - SAP Concur Community

Mileage Rate used to Claim Motor Expenses - Tax Topics

Recommended for you

-

Canadians Believe Canada Revenue Agency Goes Too Easy on Wealthy Tax Dodgers, Internal CRA Report Says17 May 2024

Canadians Believe Canada Revenue Agency Goes Too Easy on Wealthy Tax Dodgers, Internal CRA Report Says17 May 2024 -

CRA - Crunchbase Company Profile & Funding17 May 2024

CRA - Crunchbase Company Profile & Funding17 May 2024 -

Home - The City of North Miami Community Redevelopment Agency (CRA)17 May 2024

Home - The City of North Miami Community Redevelopment Agency (CRA)17 May 2024 -

CRA-Z-Art Crayons, 24 Count (6 Pack) : Arts, Crafts & Sewing17 May 2024

CRA-Z-Art Crayons, 24 Count (6 Pack) : Arts, Crafts & Sewing17 May 2024 -

Cra-Z-Art School Quality Multicolor Crayons, 24 Count, Back to School Supplies17 May 2024

Cra-Z-Art School Quality Multicolor Crayons, 24 Count, Back to School Supplies17 May 2024 -

Cra-arc.gc.ca - Is Canada Revenue Agency Down Right Now?17 May 2024

Cra-arc.gc.ca - Is Canada Revenue Agency Down Right Now?17 May 2024 -

CRA Today Woman Owned. Community Development Driven.17 May 2024

CRA Today Woman Owned. Community Development Driven.17 May 2024 -

Should consumer protection failures play a bigger role in CRA grades?17 May 2024

Should consumer protection failures play a bigger role in CRA grades?17 May 2024 -

GitHub - microsoft/CRA: Common Runtime for Applications (CRA) is a software layer (library) that makes it easy to create and deploy distributed dataflow-style applications on top of resource managers such as Kubernetes17 May 2024

-

The top reasons why the CRA may review or audit tax returns - The Globe and Mail17 May 2024

The top reasons why the CRA may review or audit tax returns - The Globe and Mail17 May 2024

You may also like

-

The No-Tools-Required DIY Product Trend We're Seeing Everywhere Right Now & How It's Become The Ultimate IKEA Hack - Emily Henderson17 May 2024

The No-Tools-Required DIY Product Trend We're Seeing Everywhere Right Now & How It's Become The Ultimate IKEA Hack - Emily Henderson17 May 2024 -

More on gluing, surfacing and repairing styrofoam17 May 2024

More on gluing, surfacing and repairing styrofoam17 May 2024 -

KoolStone Rock Tumbler Review - Kimola17 May 2024

KoolStone Rock Tumbler Review - Kimola17 May 2024 -

Sew Alongs Page Fat Quarter Shop17 May 2024

Sew Alongs Page Fat Quarter Shop17 May 2024 -

Deborah Glitter – inNAILvations Salon & Supply17 May 2024

Deborah Glitter – inNAILvations Salon & Supply17 May 2024 -

Christmas Themed Party Decorations Supplies Includes Xmas Deer Snowman Santa Claus Honeycomb Balls Banner, Paper Snowflake Fans, Paper Lanterns, POM Poms Flower - China Christmas Party Decoration Supplies and Party Paper Decoration17 May 2024

Christmas Themed Party Decorations Supplies Includes Xmas Deer Snowman Santa Claus Honeycomb Balls Banner, Paper Snowflake Fans, Paper Lanterns, POM Poms Flower - China Christmas Party Decoration Supplies and Party Paper Decoration17 May 2024 -

Cocomelon Decorate Your Own Water Bottle – ANN HOWARD Gifts17 May 2024

Cocomelon Decorate Your Own Water Bottle – ANN HOWARD Gifts17 May 2024 -

NICROHOME 24PCS Halloween Wrapping Paper in 4 Colors, 20 x 28Inch Dark Tissue Paper for Gift Bags, Box Wrapping, Wrapped Small Gifts, DIY Craft17 May 2024

NICROHOME 24PCS Halloween Wrapping Paper in 4 Colors, 20 x 28Inch Dark Tissue Paper for Gift Bags, Box Wrapping, Wrapped Small Gifts, DIY Craft17 May 2024 -

Dynarex Gauze Sponges, Bulk Packaging, Various Sizes, Various Quantiti – Rhino Medical Supply17 May 2024

Dynarex Gauze Sponges, Bulk Packaging, Various Sizes, Various Quantiti – Rhino Medical Supply17 May 2024 -

KnitPro Natural Yarn Dispenser - The Little Yarn Store17 May 2024

KnitPro Natural Yarn Dispenser - The Little Yarn Store17 May 2024